Conquer Checkout Confusion: A Comprehensive Guide to Sales Tax Calculators

Conquer Checkout Confusion: A Comprehensive Guide to Sales Tax Calculators

Have you ever stood at the checkout counter, surprised by the final price after sales tax was added? You're not alone. Sales tax rates can vary significantly depending on your location, and it can be challenging to keep track of them all. This is where a sales tax calculator comes in – a handy tool that helps you estimate the final price you'll pay, avoiding checkout surprises and budgeting more effectively.

This guide delves into the world of sales tax calculators, explaining their purpose, benefits, how they work, and offering tips for choosing the right one. We'll also explore some popular options, including a closer look at the example provided,adwat.site.

Demystifying Sales Tax: A Quick Primer

Sales tax is a levy imposed by a governing body, typically a state or local jurisdiction, on the sale of certain goods and services. The tax rate is usually expressed as a percentage of the purchase price. For instance, if the sales tax rate is 8%, and you buy a shirt for $20, you'd pay an additional $1.60 in sales tax, bringing the total cost to $21.60.

Sales tax can be a significant factor in your purchasing decisions. Knowing the sales tax rate in advance allows you to:

- Budget accurately: Factor in the additional cost of sales tax when planning your budget.

- Compare prices effectively: Compare prices across stores and locations while considering the varying sales tax rates.

- Avoid checkout surprises: Prevent sticker shock at the cash register by knowing the estimated final price.

- Make informed online purchases: Calculate the total cost with sales tax included before completing your online order.

The Power of Sales Tax Calculators: Simplifying the Process

Sales tax calculators are digital tools that simplify the process of calculating the final price with sales tax included. They typically consist of two main components:

- Price input field: Enter the pre-tax price of the item you're considering purchasing.

- Sales tax rate: Select the appropriate sales tax rate for your location. Some calculators allow manual input of the rate, while others automatically determine it based on your zip code or IP address.

Once you input the price and sales tax rate, the calculator performs the calculation and displays the estimated total price, including sales tax. This provides you with a clear picture of what you'll pay at checkout.

How Sales Tax Calculators Work: The Formula Behind the Magic

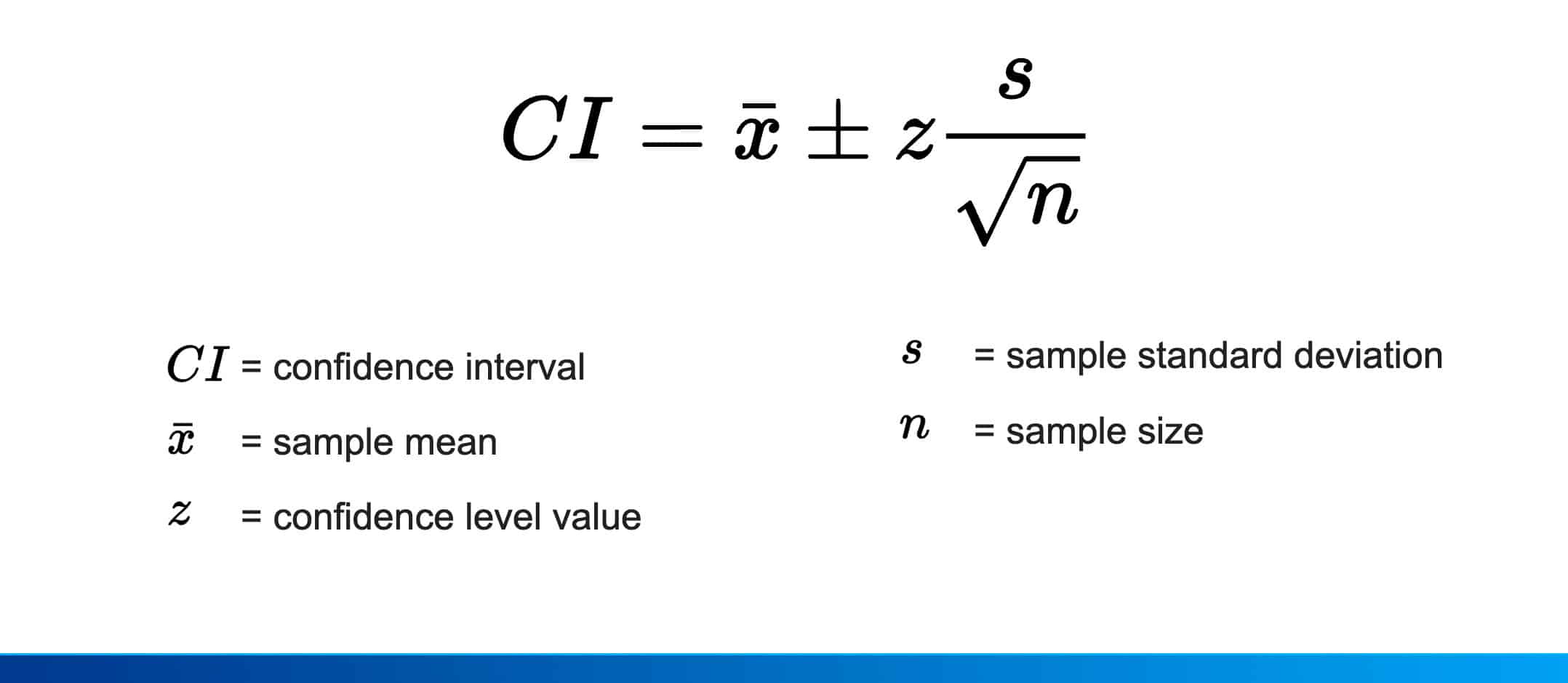

The core calculation behind a sales tax calculator is quite straightforward. It follows this formula:

Total Price = Price before tax + (Price before tax * Sales tax rate)

Let's break it down with an example:

- Price before tax: $50.00

- Sales tax rate: 7% (converted to decimal: 0.07)

Total Price = $50.00 + ($50.00 * 0.07) = $50.00 + $3.50 = $53.50

Therefore, with a 7% sales tax rate, the estimated final price for the $50 item would be $53.50.

Some calculators might offer additional features, such as:

- Multiple tax rates: Account for situations with separate state and local sales tax rates.

- Tax-exempt items: Indicate items that are exempt from sales tax, providing a more accurate calculation.

- Rounding options: Specify how sales tax should be rounded (up, down, nearest penny).

These features enhance the accuracy and flexibility of the sales tax calculator.

Choosing the Right Sales Tax Calculator: Factors to Consider

With a variety of sales tax calculators available online and in mobile apps, selecting the right one for your needs is essential. Here are some key factors to consider:

- Accuracy: Ensure the calculator uses reliable and up-to-date sales tax rates.

- Ease of use: The interface should be user-friendly and straightforward to navigate.

- Features: Choose a calculator with features that suit your needs, such as multiple tax rates or tax-exempt item options.

- Privacy: If the calculator requires personal information like your zip code, understand how that data is collected and used.

- Cost: Some calculators offer free basic features, while others might require a subscription fee for advanced functionalities.

Here's a quick comparison of popular sales tax calculators, including the example provided: